Coimbatore Blog

Coimbatore News

Free Local Business Listing Sites

Top Free Local Business Listing Sites In India 2020 with Instant Approval

Popular business listing sites in India 2020 with Instant approval

1. Google My Business

Creating a business listing will also increase your website traffic which ultimately improves your ranking in search result.2. Justdial:

Justdial is also the most popular local business listing sites in India. Justdial has both free and paid plan which will your business to grow. Just submit your website with proper optimizing your business listing which will drive quality traffic your site and will also give backlinks to your site.Other Sites to Increase Traffic

Submit your business with Coimbatore Business Directory it is free

https://www.trustpilot.com

www.brownbook.net

www.indiamart.com

https://in.enrollbusiness.com

Local Business Listings & Directories for Small Business Marketing

- Coimbatore Business directory (For Coimbatore listings => Coimbatore-biz.com)

- Facebook (Domain Authority = 100)

- Apple Maps (Domain Authority = 100)

- Google My Business (Domain Authority = 100)

- LinkedIn Company Directory (Domain Authority = 98)

- Bing (Domain Authority = 94)

- Yelp (Domain Authority = 94)

- Better Business Bureau (Domain Authority = 93)

- Foursquare (Domain Authority = 92)

- MapQuest (Domain Authority = 92)

- HubSpot (Domain Authority = 91)

- Yellow Pages (Domain Authority = 91)

- Angies List (Domain Authority = 91)

- Yahoo! Local (Domain Authority = 91)

- Manta (Domain Authority = 87)

- Merchant Circle (Domain Authority = 86)

- Super Pages (Domain Authority = 84)

- Yellow Book (Domain Authority = 83)

- Thumbtack (Domain Authority = 82)

- Local.com (Domain Authority = 77)

- Kudzu.com (Domain Authority = 76)

- Hot Frog (Domain Authority = 76)

- Communitywalk.com (Domain Authority = 75)

- Brownbook.net (Domain Authority = 73)

- Tupalo.com (Domain Authority = 72)

- La Cartes (Domain Authority = 68)

- 2findlocal.com (Domain Authority = 67)

- ezlocal.com (Domain Authority = 67)

- ebusinesspages.com (Domain Authority = 67)

- Spoke (Domain Authority = 66)

- Chamberofcommerce.com (Domain Authority = 66)

- City Squares (Domain Authority = 66)

- Cylex USA (Domain Authority = 66)

- yelloyello.com (Domain Authority = 66)

- BOTW (Domain Authority = 65)

- worldweb.com (Domain Authority = 65)

- ibegin.com (Domain Authority = 63)

- Get Fave (Domain Authority = 63)

- Fyple.com (Domain Authority = 63)

- Company.com (Domain Authority = 60)

- Call Up Contact (Domain Authority = 60)

- Finduslocal.com (Domain Authority = 60)

- My Huckleberry (Domain Authority = 59)

- Hub.biz (Domain Authority = 59)

- where2go.com (Domain Authority = 58)

- City Insider (Domain Authority = 58)

- n49.com (Domain Authority = 58)

- My Sheriff (Domain Authority = 57)

- opendi.us (Domain Authority = 56)

- Bizhwy.com (Domain Authority = 55)

- Smartguy.com (Domain Authority = 55)

- Wherezit.com (Domain Authority = 55)

- DiscoverOurTown.com (Domain Authority = 54)

- Nexport.com (Domain Authority = 52)

- USdirectory.com (Domain Authority = 50)

- Wowcity.com (Domain Authority = 49)

- Bizadee (Domain Authority = 48)

- Wand.com (Domain Authority = 47)

- USA Business (Domain Authority = 41)

- London Business (Domain Authority = 40)

Coronavirus: Drones Support to disinfect roads and buildings

Tamil Nadu startup uses drones to disinfect roads, buildings

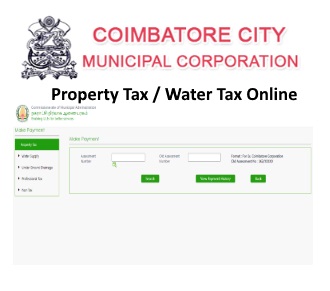

Coimbatore Property Tax Online Payment

Coimbatore Property Tax Online, and Tax Pay Online

Visitors can pay online also

Help:-

How to Pay Property Tax Online?

Vanitha Wedding Viral Video,Peter Vanitha Marriage Video

Tamil actress Vanitha Wedding Viral Video

Pragyan rolling down to lunar surface from lander, ISRO video

Pragyan Rover Chandrayaan 3 - rolling down to lunar surface from lander

Related Links...

Today Coimbatore Gold and Silver Rate

Microsoft Global outage, What is CrowdStrike issue

Pay Your Coimbatore Property Tax Online

SIR - Coimbatore booth list 2002,Name Search in Electoral Rolls

Keto Diet: What is a Ketogenic Diet?

Watch Free Movies Online, Best Free Movie Streaming Sites

EKYC JIO SIM Activation Process Using Aadhar Card

Pragyan rolling down to lunar surface from lander,ISRO Video

Lemsip Max Cold & Flu Lemon, 10 Sachets

Most Popular Dog Breeds,pictures and Breeds information

Godown ID cannot be null, Correcting Smart Card details in TNPDS site

Jana Nayagan Oru Pere Varalaaru Lyrical Video

IPL 2021 Cricket Match Full Schedule

India Vs Ireland 2nd T20 Match Highlights,Deepak Hooda Century, SanjuS

Inian Lunar Rover Pragyaan takes a walk on the MOON

Jana Nayagan – Thalapathy Kacheri Lyric Video

Train No. 06421/06422 Coimbatore – Pollachi – Coimbatore Daily train

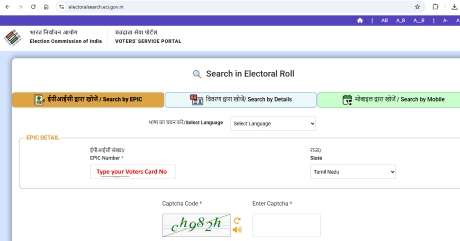

SIR -2026 DRAFT SEARCH, SEARCH YOUR NAME OR EPIC NUMBER

CAR INSURANCE, Buy & Renew Car Insurance Online,Upto 75%* Off

Explore All popular Cat and Kitten Breeds, specification and health et

ஓமிக்ரானை கட்டுப்படுத்த

ஆஸ்ட்ராஜெனெகா பூஸ்டர் டோஸ்

FirstCry India - Baby & Kids Shopping & Parenting

Nov 26 - PSLV C54,ISRO to launch Oceansat-3,8 nano satellites

James Webb Space Telescope - First Image NASA

Latest News on Coimbatore Metro 2023

CSK VS RCB, IPL 2021,Twenty-20

Indian Railways starts 200 special trains from 1/6/2020

பாரத மண்டபத்தில் நிறுவப்பட்டுள்ள பிரமாண்டமான நடராஜர் சிலை

Photo : Vikram Lander on the moon's surface, Moon rover Pragyaan snap

TOP 25 Indian Universities Ranking 2022-23

Horai in tamil, எந்த ஹோரைகள் அனுகூலத்தைக் கொடுக்கும்?

ஓமிக்ரோன் கொரோனா new COVID-19 variant (B.1.1.529) SARS-CoV-2

காதல் கல்யாண யோகம் கை கூடி வரும் ராசி

திருமணத்தில் கவனிக்க வேண்டிய பொருத்தங்கள்

College Admissions

மூலிகை மருத்துவம்

Weight Loss

Upcoming Movies

Tirupati Seva Timings

Tirupati info

School Jobs

Pin-Code

Pets Name

New Technology

Movies Trailers Theaters

Employment Registration

100% UK Scholarships

Coimbatore Train Timings

Coimbatore Temples

Coimbatore News

Coimbatore Jobs

Coimbatore Gold Rate

Coimbatore Call Taxi

Coimbatore Bus Routes

Bollywood Collection

Bill Payments

American dishes

Online Shopping

Baby Names by Birth Star

Latest Post

/Coimbatore News

/Coimbatore News

/Coimbatore News

/Coimbatore News

/Online Shopping